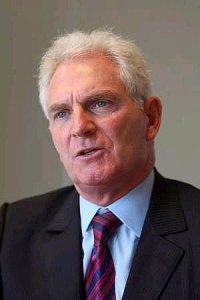

Dr. Naser Saidi of DIFC says Dubai’s debt crisis will make state owned companies in the city state more transparent.

Dr. Naser Saidi of DIFC says Dubai’s debt crisis will make state owned companies in the city state more transparent.

Saidi was Speaking during a panel discussion hosted by Bloomberg News, in Dubai, “The region never faced a crisis like this. This is really going to be giving an impetus for change and reform. ” he said

“Greater clarity I think will come out of this in terms of the ownership, who owns what and what they do.” Saidi Added

On December 14, Abu Dhabi provided $10bn to help the state owned Dubai World avoid defaulting on a $4.1bn bond payment. Dubai World roiled markets worldwide when it said December 1 it was in talks with creditors to restructure $26bn of debt.

Abu Dhabi is the largest of the seven sheikhdoms in the UAE and has more than 90 percent of its oil reserves, the world’s sixth largest.

Dubai, the second largest emirate, borrowed $80bn to diversify away from dwindling oil supplies and build itself into a financial and tourism hub.

The remaining $22bn of debt held by Dubai World will require restructuring in the framework of a new bankruptcy law, said Farouk Soussa, a Standard & Poor’s credit analyst.

He said: “The rest of the $22bn that remains within Dubai World is still being restructured and to top it all off, we’re actually putting in place a legal framework for dealing with insolvency should it come to that.”

Soussa said December 8 that the restructuring process would “obviously” include discussion over the sale of assets.

Soussa said December 8 that the restructuring process would “obviously” include discussion over the sale of assets.

Dubai World may sell assets in the UAE and abroad to repay its borrowings, Abdulrahman Al Saleh, director general of Dubai’s Department of Finance and head of the government fund that’s leading the Dubai World renegotiation, said December 6.

Dubai World owns Nakheel, the property unit that issued the $4.1bn bond and is building palm tree shaped islands off the coast.

The bond was partly secured on the now abandoned Dubai Waterfront project, a barren strip of wasteland which was to be a development twice the size of Hong Kong Island, according to the offering’s prospectus.

Dubai World also owns 80 percent of DP World Ltd, the world’s fourth biggest port operator, and the Jebel Ali Free Zone, a business park adjoining its flagship Jebel Ali port in Dubai.

Its Istithmar division bought New York luxury retailer Barneys in 2007 for $942.3m, while Dubai World itself acquired a $5.1bn stake in US casino company MGM Mirage in 2008.

Dubai’s debt difficulties will persist into 2010 and 2011. Dubai must repay at least $55bn in the next three years, Goldman Sachs Group Inc said December 13.

John Sfakianakis, chief economist at Banque Saudi Fransi, Riyadh, said: “Definitely the Dubai model is based on exuberance based on available liquidity that the global financial system provided for some time.

“Some debt is good, but not a lot of debt. This is what Dubai is finding out in a difficult way.”